1 min read

5 Impacts of Bitcoin on Economy, Banking & Finance

Cryptocurrencies are disruptive economic innovation that have the potential to revolutionize the current economic structure and change how banks and...

Internet of Things(IoT) is the interconnectivity of mobile and other physical devices over a network. These devices are able to transmit signals to the server and to each other. By using this data from different data points we can get access to a large amount of data which upon filtering can present key insights into various processes of a company. Because of its potential, IoT it is gaining huge traction in businesses across the world. Industries like healthcare, banking and retail are all figuring out ways to leverage the potential of IoT to bring out better revenues from business activities.

While IoT in banking is still more in a planning stage, we can be sure that there is ample scope for innovations. Starting from an increase in revenues to better customer services, banks are always on the hot seat to bring out new and better innovations. Here we have created a small picture of the scenario of IoT in Banking.

Download our eBook to understand how modern technologies are impacting Banking and Finance industries:

By using the data collected from sources like mobile apps, banks can launch better and more targeted service offerings. What services and products to launch? Who will be the key targets? When is the right time to launch the products? - All these questions can be answered using data about the past service offerings and the reaction of customers for the same.

Customers across the industries are demanding personalized solutions for their varying needs and BFSI is no different. In order to tailor a banking solution to a client, information is needed about his present economic condition, buying behavior & individual needs. IoT has made it possible for banks to keep a track of all consumer activities and present a solution specific to the needs and desires of the client.

Service faults and upcoming products changes can be handled much easily using IoT in banking and financial industries. If there is an underlying concern about a product then it will come to notice quite easily and steps can be taken to handle the issue before it becomes too serious. Along with this, a record of the past activities of the customer can help service representatives provide better solutions.

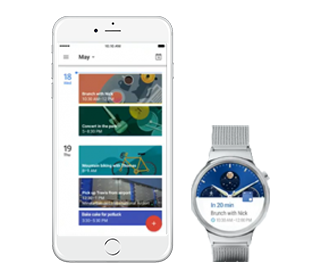

Wearable technologies are now getting popular day by day. Due to wide adoption, enabling banking in wearables has become a primary target for banks across the world. Right now most of the watches are connected with the phone but there have been plenty of innovations to allow for independent wearables. This has made wearables a hot seat for banking innovation as well.

Along with wearables, remote devices like Amazon Alexa are also a focus area where innovation banking is necessary. Basic banking like balance check and transaction history are some must haves in every wearable and remote assistant device.

Internet of things adds the power of data to the decision-making process of a business. But how exactly will you go about collecting that data? Banks currently are focusing on 2 key data sources to power their IoT innovations:

A mobile app is the most basic and necessary IoT application. The number of users on mobile are massive and thus it is the hottest market for innovation. While most of the banks already have mobile apps for banking very few of them have an analytics framework attached that can provide data at a large scale. Data can be generated from behavior insights, user interactions and reviews. It is the easiest and most reliable source of data that banks can leverage to generate insights into the market.

Digital sensors can be placed in physical units like bank branches and ATMs to analyze consumer behavior. These digital sensors can report for unexpected customer problems, service issues and the ease in operating ATM and other automated machines.

Read More: What is Data Governance and How does Impact IoT Data Collection?

As we have seen IoT can play a major role in banking and finance. With time many other data points will add and the level of personalization will increase from marketing to customer service. IoT has a huge potential in turning the way we are served and how banks and financial institutions take a decision.

Want to leverage IoT for business? Catch our latest eBook on the 5-step strategy for using Internet of Things in business:

1 min read

Cryptocurrencies are disruptive economic innovation that have the potential to revolutionize the current economic structure and change how banks and...

Artificial intelligence (AI) has brought upon one of the biggest revolutions in the banking industry. Where traditional software was hard-coded with...

Cloud computing has been on the radar of many CTOs, CIOs, and CFOs. Being one of the rapidly developing technologies it has gained massive traction...