How can Blockchain technology topple the FinTech market

Blockchain is transforming everything! Be it payments transactions or how money is raised in the market, this life-altering technology is...

4 min read

Anurag : Feb 6, 2018 11:30:00 PM

In 2008 a person with pseudonym Satoshi Nakamoto introduced a revolutionary technology into the digital world. We now have access to a digital financial market that has opened gates to a host of new possibilities. While the geeks have always been clear about the technology involved in the initiative many are still confused about the basic terminology. Bitcoin, Blockchain, and Cryptocurrency have become the common topics of discussion especially after the recent surge in Bitcoin value. In this blog, we will clarify the basics of the technology and explain distinction between blockchain and bitcoin, in layman terms, to help you understand all of this in the right sense.

Want to catch the latest Blockchain development? Download our free ebook on Blockchain innovations, strategies and businesses today:

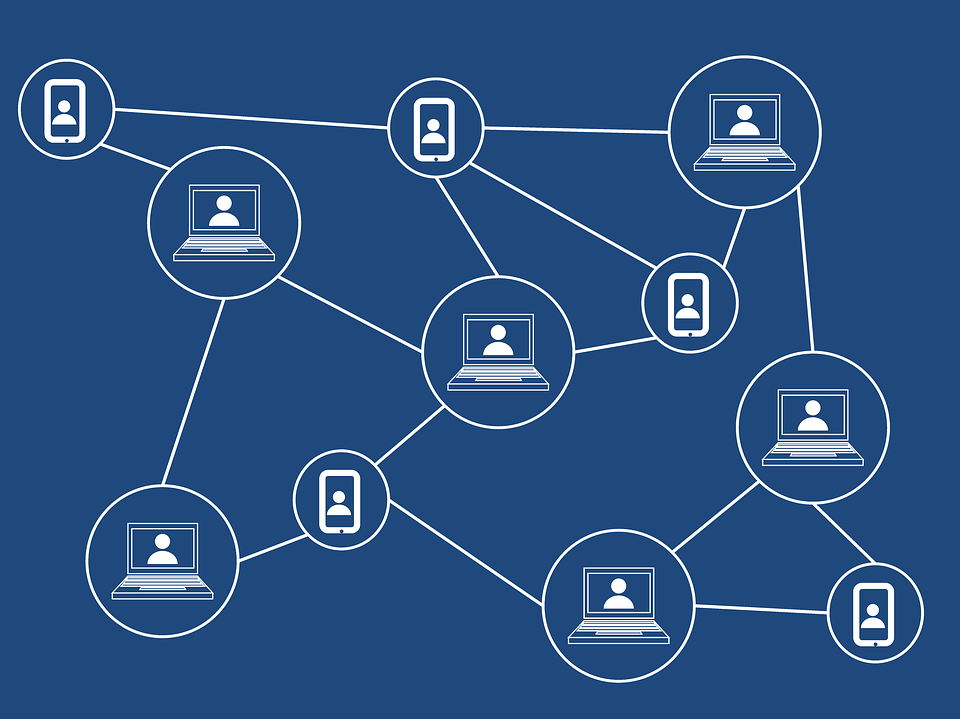

The blockchain is an encrypted distributed ledger that allows us to create an immutable log of all the transactions while ensuring complete anonymity of the user. Each transaction is verified by a peer-to-peer network of systems called consensus. To verify a transaction the network of computers solves a memory intensive problem, this process is called mining. Once a transaction is verified and completed it is recorded in the block. Each block is connected to a chain of blocks that hold information about previous transactions and once it is completed a new block is automatically created and attached to the chain - hence the name blockchain.

Samuel Scott, Promotion Fix columnist for The Drum explained this in a much simpler language. In basic terms, Blockchain is like a gigantic Google spreadsheet in the cloud. Whenever someone in the network makes a transaction and “edits” the ledger, everyone else verifies the change and sees the updated ledger. No other party – such as a government, bank, or financial institution – is needed.

Here is the basic idea:

Now, just imagine the same example – but the networks consist of 500 or 5 million people. That is blockchain.

Read More: What is Ethereum Blockchain and How Does it Work?

Bitcoin is a blockchain-based digital currency that allows us to anonymously execute a transaction online. It uses the blockchain technology as the base for executing the transactions. Bitcoins are provided to the miners as a reward for their computing power. The basic difference between Bitcoin (or any cryptocurrency for that matter) and the Government issued currency is that the bitcoin is not backed by any other valuable like gold or foreign exchange. It is a peer to peer currency and its value depends on the market demand just like that of shares.

Overtime Bitcoins has implied both positive and negative impacts on the current financial system and has been a part of multiple debates. The obvious distinction between Bitcoin and Blockchain is that Blockchain is a technology which can be used for decentralizing any centralized function say banking, record maintenance, voting etc. On the other hand, Bitcoin, i.e. a cryptocurrency is just one of the many possible applications of the tech.

The future potential of blockchain and bitcoin are highly controversial topics. While some believe it is all a hokum many are positive about the use cases and potential this technology offers. To give you a clearer outlook we asked some crypto experts to weigh in on the subject. Here is what some of them feel about the debate - blockchain vs bitcoin:

“Bitcoin was designed as a currency but has ended up being more of a commodity due to its inability to scale. Think of it as the cryptocurrency equivalent of the Sony Walkman; it has dominated the sector and encouraged great innovation, but is now being succeeded by superior tech. I do believe there is a place for Bitcoin in the crypto market, but while the Bitcoin community remains apprehensive to change, development of the technology is hindered.

Blockchain, on the other hand, has use cases ranging a broad spectrum. Blockchain projects that utilize this technology, such as Ethereum, provide the "world computer" on which all sorts of programs (DAPPs) can run. The blockchain is the Android OS to your Twitter app or maps program. Blockchain has encouraged innovation across many industries; from energy to insurance, to supply-chain. The potential use cases are growing at an astounding rate. Sooner or later blockchain will be ingrained in our daily lives, much like the internet is today.”

- Greg Adams, Proprietor & Managing Director, Blokt @bloktgreg

“Blockchain and bitcoin are two sides of the same coin...pun intended. Bitcoin is nearly impossible for the average consumer to invest in at present, making it a hot potato for the wealthy and those with computing power. Blockchain technology, however, has the potential to touch everyone from the digitally unaccounted for to major industry. Blockchain reveals a new digital ecosystem that corporations, government, and cyber experts are mobilizing around. Whether or not it will live up to its height of being "the next internet" remains to be seen-if stringent controls are applied then Blockchain's impact may be limited. But, as is the case with most technology, there's no telling what will happen.”

- Alice, Toronto tech enthusiast, and Blogger @YesToTech

“While the possibilities of Blockchain may be endless, the future of Bitcoin is clearer. We believe Asia-news-weary investors have underreacted to Mitsubishi Bank’s epic announcement to launch, custody, and trade digital currencies. There are few financial sectors in the world that act more conservatively or deliberately than the one in Japan, and Mitsubishi bank, Japan’s largest bank, just made 4 huge bets on the long-term existence and viability of digital currencies. These announcements will have an enormous impact on South Korean legislators and financial institutions. South Korea is now left with essentially no choice except to follow Japan’s lead and fully commit to embracing digital currencies or else risk sacrificing their countries banking sector on the altar of indecision/over-regulation.

The prohibition of digital currencies- which had been so badly spooking the markets- is no longer a viable outcome. Traditional banks around the world will spend 2018 and 2019 assimilating digital currencies into their stable of regulated financial assets. Doing so should spur demand for Bitcoin and other digital assets well beyond today’s prices. $100,000 Bitcoin in five years is easily achievable IF it remains the most prominent and demanded among all digital currencies. We recommend investors hold full positions in Bitcoin and other large-cap cryptocurrencies.”

- John R. Sarson, Managing Partner and Chief Risk Officer for Blockchain Momentum, LP.

While Bitcoin may or may not make it to everyone’s wallet blockchain is here to stay. With the potential of making anything, decentralized blockchain offers a huge potential. Our team at NewGenApps has developed deep expertise in working on latest technologies like blockchain, IoT, artificial intelligence etc. If you have a project where you need a team which is always ready take up a challenge then get in touch with us.

Blockchain is transforming everything! Be it payments transactions or how money is raised in the market, this life-altering technology is...